securespend.com Activate Card: Greetings, dear readers! It is easy to activate the SecureSpend prepaid Visa gift card at Securespend.com/activate, and it offers a quick and secure way to make transactions anywhere a Debit MasterCard is accepted.

The SecureSpend card protects your personal information during online transactions, unlike other methods. Suppose you’ve decided to utilize a SecureSpend card.

If so, this blog will provide you with all the information needed to activate and use your Securespend Prepaid Visa Card properly.

You will be provided with a thorough explanation of the card’s functionality and activation procedure, permitting you to use the card and benefit from its capabilities immediately.

What is Secure Spend?

A prepaid card or MasterCard card from Securespend.com is available for use for a variety of transactions, such as online booking, hotel bookings, gas refills, and the purchase of any brand clothing item or jewelry from well-known brands and merchants.

Several businesses, such as Dollar General, Sam’s Club, Circle K, CVS Pharmacy, 7-Eleven, Cumberland Farms, etc. accept SecureSpend cards for payment.

Using SecureSpend entitles you to FDIC insurance on your money. You can issue money with securespend.com without having a bank account.

Being older than 18 is the only prerequisite for obtaining a Securespend.com account. Your SecureSpend card will arrive in 5-7 working days after you apply.

Your confidential information is also protected and kept hidden from retailers.

SecureSpend.Com Visa Debit Card Information

You can use a prepaid card or visa card from SecureSpend.com for several things, such as making online reservations, booking hotel rooms, refueling your car, and buying brand apparel and jewelry from well-known brands and merchants.

Many different businesses, such as Dollar General, Sam’s Club, Circle K, CVS Pharmacy, 7-Eleven, Cumberland Farms, etc. accept SecureSpend cards as payment.

Using SecureSpend gives you FDIC protection for your money. You don’t need a bank account to issue money when using SecureSpend.com.

Only being older than 18 is required to open a SecureSpend.com account. After submitting your application, it usually takes 5-7 business days to get your SecureSpend card.

Additionally, all of your private information is secure and is not shared with merchants.

Create An Account

On SecureSpend Com, creating an account is a simple process. Creating a personal account is easy if you follow the guidelines if you still need one.

- A username and an email address are also required.

- Make a strong password for your account next.

- Make sure the password is correct before moving on to the next step.

- Then, the respondent will be asked the first security query. Continue by giving truthful responses to these questions.

- Next, you will be required to answer the second Security Question.

- By choosing Next, you can add your card information.

- You need to use at least eight characters—uppercase, lowercase, at least one special character, and one number—to make a secure password.

Login by Secure spend.com

Following the login page being opened, the steps you must take are listed below.

- Enter your email address here.

- Then, enter a secure password.

- Whenever using this device, check the “Remember Me” box.

- Do not worry if you forget your password; you can also retrieve it.

How To Securespend Activate Card?

One of the most popular cards available is the SecureSpend Visa card. Every time you go shopping, you may take advantage of the many benefits that come with this card.

However, you must first make a purchase using your SecureSpend Card to take advantage of these benefits.

After choosing “Credit” or “Debit” on the keypad, sign the receipt. You must select a PIN for your Card before using it to conduct a debit transaction.

Your whole balance—along with any applicable taxes and other fees—is deducted when you make a purchase using your Card.

You can use your SecureSpend Card to cover the entire transaction, including any relevant taxes if your balance is sufficient.

You must inform the merchant in advance of finishing the transaction if you intend to use two payment methods to purchase more than the remaining balance.

Your SecureSpend Card may be denied if you attempt to make a purchase that will exhaust your available balance. You might be able to pay in two ways at some places.

Not all establishments accept split payments, and some could need you to pay the balance in cash. First, confirm with the supplier.

Scecurespend Prepaid Visa Card

The Securespend Prepaid Visa Card was introduced by Comenity Bank N.A. in 2003, which Synchrony Bank acquired in 2014.

When the Secured MasterCard was first introduced by Comenity Bank N.A., it was the perfect option for people with bad credit or no credit history because it gave them a way to improve their score while still taking advantage of credit card convenience and learning how to properly budget and manage their money.

The company was eventually able to create the Securespend Card, which provides a great deal more benefit flexibility.

How To Use SecureSpend Card? Securespend Card Activate

SecureSpend, a prepaid gift card, ensures the confidentiality and security of your financial transactions.

To use your SecureSpend Card to make purchases online, follow these steps:

Check to see if the amount on the SecureSpend Card exceeds the total transaction cost, including taxes.

Please be advised that certain transaction types may need a hold of up to 20% of the purchase price.

Your Cardholder Agreement has more information.

- Choose “Credit” or “Debit” rather than “Gift Card” as your payment option.

- Enter the credit or debit card details in the Payment Method just as you would with a credit or debit card.

- Give your name and address in the “Billing Address” field.

Features of Securespendcom

Prepaid cards like SecureSpend Com are popular for making online purchases and bill payments, but they cannot be recharged.

All of your private data and financial transactions here are 100% safe thanks to their modernized system.

To utilize SecureSpend.com, your card must also have a specified amount on it and be usable without your bank’s authorization.

- Securing your experience with SecureSpend Com during transactions is their top priority.

- Their customer service system is accessible to customers around the clock.

- Obtaining and using the card is very simple.

- As soon as you buy it, you can use your SecureSpend Com at a huge variety of locations all over the United States.

- People primarily use their SecureSpend Com accounts for various things, including paying their restaurant bills, covering travel expenses, shopping both online and offline, etc.

- Your personal information is secure because registration is not necessary.

- You do not have to be concerned about your account’s balance because they did not charge anything.

Benefits of Securespend activate

Users of prepaid cards like SecureSpend benefit from several benefits. The following are some benefits of utilizing a Securespend Visa prepaid card:

- Users of the SecureSpend card are given security. The business has put in place a highly updated system to guarantee the security and safety of your personal information and money transfers.

- The card is easy to obtain and use. A SecureSpend card only needs to be purchased with a certain amount, and you can use it immediately without your bank’s approval. These cards are available at thousands of retail locations across the US, making them simple to buy and use.

- Using SecureSpend cards for various activities, including online shopping, bill payment, dining out, and other activities, is easy and secure. The business works hard to give its customers the safest and most practical experience possible.

- The privacy that a SecureSpend card offers is among its most alluring features. The card can be used without having to register, protecting the privacy of your personal information.

- A SecureSpend card makes it simple to keep track of your spending because there are no additional costs after the initial purchase. The business also offers customer support seven days a week, round-the-clock, to ensure users can get help whenever needed.

Where To Buy The SecureSpend Card?

SecureSpend Prepaid Mastercards and SecureSpend Prepaid Visa Gift Cards are two different card kinds that are issued by MetaBank NA. These well-known retailers offer the SecureSpend card to customers:

CVS 7-11 Walgreens Dollar General Family Dollar Walmart Rite Aid

Other SecureSpend Gift Cards

Vanilla Visa Gift Card Walmart Money card PayPal Gift Card Famzoo Prepaid Card

The SecureSpend Card Used For Shopping

SecureSpend cards can be utilized for payments, food delivery, travel, and other activities. The security of your economic and personal data is the primary reason for its favor.

The following guidelines must be followed when making purchases with your SecureSpend card.

- Before making a purchase, always double-check the balance on your SecureSpend card. Check to see if the card amount exceeds the product’s actual cost.

- Never pay with gift cards when buying something; instead, use a debit or credit card.

- Always provide accurate card information When completing a credit or debit card payment method.

- Fill out the billing address field with your true name and address.

- When transferring money, you may be required to have 20% of the purchase price in your account, so make sure you meet this requirement before proceeding.

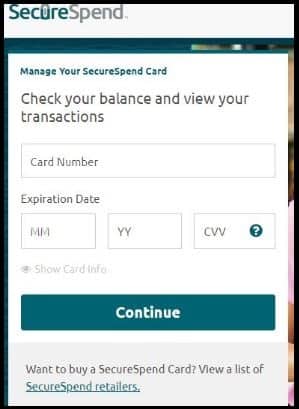

How To Check Your SecureSpend Visa Card Balance?

Visit this page to determine your balance. Give the details on the following page as follows:

- Expiration Year, Expiration Month (MM), and Card Number (Y)

- Code for Card Security (CSC)

- The third or fourth rightmost digit in the signature area on the back of your credit card is the CSC (Card Security Code) or ID of your card.

- Tab the “Go” button.

This will display all your information related to your SecureSpend Visa Card Balance.

Check SecureSpend Balance Online

If you are using a SecureSpend card and want to check your account balance, you must complete these steps.

- You must first go to the official website, www.securespend.com.

- Enter your card number accurately after that.

- Always input your card expiration date after entering your card number.

- Finally, press the green Sign In button.

- All of the information on your balance and transactions will be available after you sign in.

Contact Customer Support Team

- Call them at the number 1-833-563-8200.

- Write them a message related to your card loss.

- PO Box 826

- Fortson, GA 31808

Conclusion

Secure Spend.Com makes it exceedingly simple to transfer money and conduct everyday transactions. It works with many different locations and online retailers. There is no other method for you to utilize Secure Spend.Com than having a bank account.

A sum of $10 or up to $5,000 can be placed into this card. Another vital aspect is that no one will ever discover your identity when you use Secure Spend.Com at merchants like Rite Aid Pharmacy, Speedway, Food City, Sheetz, etc.

We have discussed everything there is to know about Securespend Visa prepaid cards in this blog. Consider the scenario where you realize your SecureSpend card needs to be used while making an online transaction.

FAQs: securespend.com Activate Card

What is securespend.com?

Securespend.com is a website that lets users activate their Secure Spend Prepaid Visa Gift Card.

How do I activate my Secure Spend Prepaid Visa Gift Card?

To activate your Secure Spend Prepaid Visa Gift Card, visit the securespend.com website and follow the activation process outlined on the site.

What information do I need to activate my Secure Spend Prepaid Visa Gift Card?

You will need to provide the card number, expiration date, and CVV code to activate your Secure Spend Prepaid Visa Gift Card.

Can I activate my Secure Spend Prepaid Visa Gift Card over the phone?

The activation process may vary depending on the issuer of the card. It is recommended to follow the instructions provided on the card or visit the securespend.com website for the specific activation process.

Can I use my Secure Spend Prepaid Visa Gift Card immediately after activation?

Yes, once your Secure Spend Prepaid Visa Gift Card is activated, you can start using it for purchases wherever Visa debit cards are accepted.

Are there any fees associated with activating the Secure Spend Prepaid Visa Gift Card?

The fees associated with activating the Secure Spend Prepaid Visa Gift Card may vary depending on the issuer of the card. It is recommended to review the terms and conditions provided with the card for any applicable fees.

Can I reload funds onto my Secure Spend Prepaid Visa Gift Card?

The ability to reload funds onto the Secure Spend Prepaid Visa Gift Card may vary depending on the issuer of the card. It is recommended to review the terms and conditions provided with the card for information on reloading funds.

What should I do if my Secure Spend Prepaid Visa Gift Card is lost or stolen?

If your Secure Spend Prepaid Visa Gift Card is lost or stolen, contact the issuer of the card immediately to report the loss and request a replacement card.

Can I check the balance of my Secure Spend Prepaid Visa Gift Card online?

Yes, most issuers provide online access to check the balance of your Secure Spend Prepaid Visa Gift Card. Visit the issuer’s website or contact their customer service for more information.

What should I do if I have issues activating my Secure Spend Prepaid Visa Gift Card?

If you encounter any issues while activating your Secure Spend Prepaid Visa Gift Card, contact the issuer’s customer service for assistance. They will be able to guide you through the activation process or resolve any problems you may be experiencing.