Can You Negotiate a Reverse Mortgage Payoff?

Reverse Mortgage Payoff – The reverse mortgage is a kind of loan that permits seniors to take out loans against the equity in their homes.

In contrast To traditional mortgages, borrowers do not have To make monthly payments. Instead, the loan Is paid back at the time that the borrower moves from the property or dies.

However, in some situations, a borrower might decide to negotiate the payment of a reverse mortgage. Here’s what you should be aware of.

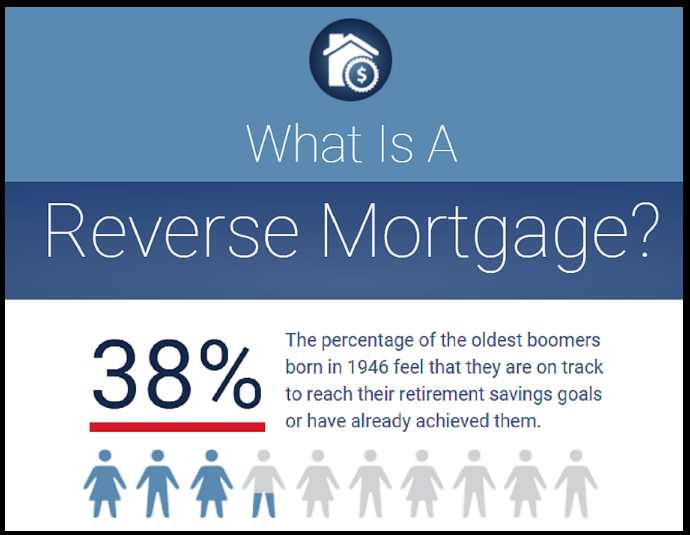

What is a Reverse Mortgage?

Reverse mortgages permit homeowners who are 62 or older To take out loans against the equity in their houses. The loan is paid back when the borrower vacates the effects or dies.

The most famous type of reverse lending is called A Home Equity Conversion Mortgage (HECM), which Is guaranteed by the Federal Housing Administration (FHA).

How Does a Reverse Mortgage Work?

A reverse mortgage Is A type of loan where the borrower receives payment from the lender instead of spending the lender.

Its amount Is contingent on many facets, such as the borrower’s age, the worth of the house, And The current interest rates. The loan Is only required to be paid back once the borrower is moved out of the home or dies.

When Does Repayment Become Necessary?

The repayment of a reverse mortgage is require after the borrower has move out of their home or dies.

The loan must be paid in the entire payment. If the borrower dies or dies, the inheritors have a range of options to repay the loan.

The homeowner can dispose of the effects and use the proceeds to repay the loan.

Refinance the mortgage or modify the loan through the traditional mortgage. They could also pay back the loan using the funds they have.

Can You Negotiate a Reverse Mortgage Payoff?

It’s possible to bargain a reverse mortgage payment with the lender. For instance, if you’re facing foreclosure, you can negotiate with your lender to discover another method to halt the foreclosure process if you repay your loan early instead of later.

In addition, reverse mortgage firms often collaborate with the borrowers and the representatives of their clients to agree on a deal place of foreclosure.

How Do You Get Out of a Reverse Mortgage?

If you’re trying to exit reverse mortgages, There are various available choices. You can sell your house and use the proceeds to repay the loan.

If you owe more money on the reverse mortgage than your house is worth, you could sell your house for less than you owe and request your lender to pay the excess. You may also refinance your reverse loan with conventional mortgages or repay the loan using your own money.

How Can You Avoid Foreclosure on a Reverse Mortgage?

If you’re having difficulty paying the reverse mortgage, there are some ways you can prevent foreclosure.

First, contact your lender immediately and let them know about the problem. They can help you find The most suitable answer to allow you to stay At home.

You may also contact a HUD-approved housing counselor for free help. If you cannot find a solution, think about selling your home before foreclosure is required.

How long do heirs have to pay off a reverse mortgage?

If the borrower who is the last to survive or the spouse eligible for a non-borrowing spouse dies, the reverse mortgage loan is owed to the estate and heirs of the deceased to pay back the loan.

Following federal law, the descendants of the dead are required to be able to repay the loan with a minimum of 95 percent of the payment estimated for their house or the house or smaller.

The lender typically provides the heirs with options for repayment, and after that, they’ll be given 30 days in which to choose. Bas on the place you live in, it could take extend to pay back the loan.

“The exact time frame is usually decided by the state,” Auerswald states. “Most reverse mortgages are due within one to six months after the owner has died.”

Conclusion – Reverse Mortgage

A reverse mortgage is an excellent way for older individuals to tap into the equity of their homes without making monthly payments.

But, there are circumstances where negotiating a reverse loan payment is requir. You have various options if you’re facing foreclosure or looking to pay off your mortgage in reverse.

Talk to your mortgage lender or a housing counselor approv by HUD for help in locating an option that is right for you.

ALSO CLICK HERE : Is Payoff Legit

FAQs

Q.1 What is a reverse mortgage?

ANS. Reverse mortgages are a form of loan allowing those aged 62 or more senior to obtain a loan against the home equity.

Q.2 When does repayment become necessary on a reverse mortgage?

ANS. The need for repayment becomes urgent if the borrower rolls out of the home or dies.

Q.3 Can you negotiate a reverse mortgage payoff?

ANS. It’s possible to bargain a reverse mortgage repayment with your lender.

Q.4 How do you get out of a reverse mortgage?

ANS. You may sell your home And utilize The proceeds to repay The loan, refinance it with traditional mortgages, or pay off The loan using cash.

Q.5 How can you avoid foreclosure on a reverse mortgage?

ANS. Contact your lender as quickly As possible, And let Them know about your present situation.

They might be willing to assist you in solving the issue that allows you to keep your home.

Q.6 What is a Home Equity Conversion Mortgage (HECM)?

ANS. A HECM is The most popular reverse mortgage type And is covered by the Federal Housing Administration (FHA)

Q.7 What happens if I owe more on my reverse mortgage than my home is worth?

ANS. It is possible to market your house At a lower price than you owe. You can also the lender will be able to pay the difference.

Q.8 What should I do if I am having trouble making payments on my reverse mortgage?

ANS. Contact your lender As quickly As possible, and let them know about the situation.

It is also possible to contact a HUD-approv housing counselor to receive help for free.

Q.9 Can I refinance my reverse mortgage with a traditional mortgage?

ANS. Yes, you can refinance your reverse mortgage by utilizing a traditional mortgage.

Q.10 How do I negotiate a reverse mortgage payoff?

ANS. To negotiate an agreement to pay off your reverse mortgage, contact your lender and describe your circumstances.

It is likely to bargain with your lender to stop foreclosure when you repay your loan earlier than later. You may also negotiate the interest rate down or convert the varying rate to fixed rates.