What Is a Payoff Letter: Definition, Uses, and Details

If you’re In The process of repaying A loan, you’ve probably seen the expression “payoff letter” or “mortgage payoff statement.” What exactly Is a “Payoffletter”, what Is Its purpose, And how necessary?

This article will explain what a “payoff” letter is, explain its purpose, And offer some essential information to consider.

What Is a Payoff Letter?

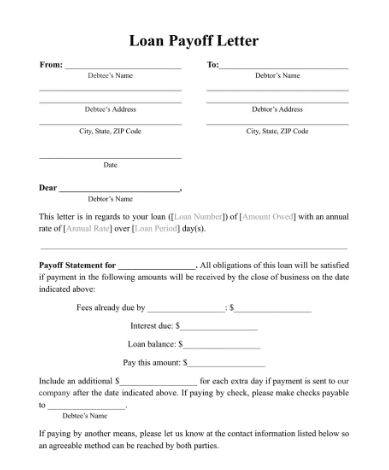

A payoff letter, sometimes called A mortgage payment statement, outlines the precise amount required to pay off the loan completely.

The amount doesn’t only reflect The outstanding balance, any fees or interest that you have to pay, And any charges your lender could charge.

A payoff letter is a document the lender prepares that provides A payment amount to pay off the mortgage or another loan.

Uses of a Payoff Letter

There Are a variety of reasons you may require a payoff letter. Here are some common situations:

Paying off a mortgage

If you’re In The process of making payments on your home mortgage, Then you’ll require The payoff letter to identify the exact amount due.

This is essential because The balance you owe might not be the same As the amount you pay off. The amount you pay off will include any interest due and any fees your lender could charge.

Refinancing your mortgage

When you refinance your mortgage, your new lender Is likely to require A payment letter from The lender you currently have.

This is because The new lender must know exactly how much you must pay on your mortgage To settle it and give you an additional loan.

Paying off other loans

Payoff letters aren’t only for mortgages. You might also require an official letter of payoff if you’re In The process of paying off other types of loans, for example, A car loan or a personal loan.

Obtaining a consolidation loan

If you’re seeking A consolidation loan, you might require an official payoff letter to find out The exact amount due on your current loans. This will allow you To determine The amount you’ll need To repay your current loans.

Details to Keep in Mind

When you request a payoff letter, There are some essential details to bear in your mind:

Fees

The amount you pay off could include charges, like early payment penalties or late fees. Make sure you know the fees that will be included in your payment amount.

Timeframe

The payoff amount could not be available for a specified time, like 30 or 10 days. Make payments on your loan in the time frame to avoid extra fees or interest charges.

Liens

Payoff letters are usually linked to liens and notify you that an official claim has been filed to take possession of the property if full payment is not made.

If you have an obligation against your home, know the procedure for releasing it when you’ve paid off the loan.

Alternatives to Payoff Letters

You may also request an estimate of your payoff at the request of your lending institution. It’s not a legally binding and official document. However, you’ll know how much cash you’ll need To pay off the loan.

It’s possible To move forward by making A payment based on an estimate from a source; however, if you received incorrect information, you cannot claim any remedy.

A verbal quote can be dangerous, but if you’re not concerned about the time it will take to resolve the issue–and are willing to wait while The money Is shuffled And The accounts Are adjusted, a verbal payment amount can help to get things moving.

Types of Payoff Letters

Another kind of letter for payoff is one you receive after you’ve completed the repayment of the loan. This letter informs you That The amount owed has been paid And can be useful when you need to prove That The loan Is no longer in existence.

For instance, if you’re selling a vehicle you’ve owed money for, the buyer may not be willing to make a move without an undisputed title. Lenders may take some time to take away the lien and provide title documents, so this kind of letter may be able to keep the process going.

A payoff letter may be useful in the event of problems with the credit file. If The credit bureau isn’t declaring A loan As open after you’ve paid it off, it will require documents to rectify the mistake. The lender’s letter will help to get the errors corrected.

Conclusion

Payoff letters are vital to documents that reveal the exact amount required to complete the loan. If you’re paying off A mortgage, refinancing your home, or applying for An installment loan, A payoff letter will help you determine The exact amount due.

Be sure To be aware of The timeframes, fees, or liens that accompany the amount you pay off to avoid Any unpleasant surprises later on.

ALSO CLICK HERE : How to Mortgage Payoff Calculator

FAQs

Q.1 What is a payoff letter?

ANS. Payoff letters, also called mortgage payment statements or payoff declarations, Are documents that list the exact amount required to pay off the loan. It will also include any interest you must pay And any fees your lender could charge.

Q.2 Why do I need a payoff letter?

ANS. You might require A payment letter when you’re paying off your mortgage, refinancing your home or paying off other loans, or seeking A consolidation loan. A payoff letter will aid you in determining the exact amount That you owe.

Q.3 What does a payoff letter include?

ANS. A letter of payoff outlines The amount required to pay off The loan, including The amount of interest due And The potential fees the lender may charge.

The letter could also include other information, like the deadline for repaying The loan, As well as any liens That Are associated with The loan.

Q.4 How do I request a payoff letter?

ANS. For a request for a letter of payoff, it is necessary to contact your lender And inform them you’d like the details.

Based on the lender you have, you should sign up for the online portal, call the helpline, or mail An official letter to begin the process of ordering A payoff letter.

Q.5 How long is a payoff letter valid?

ANS. The amount you pay off may have a limit of a specific duration, like 30 or 10 days. You must repay your loan within this time to avoid extra fees or interest charges.

Q.6 What fees might be included in a payoff amount?

ANS. Your payment amount could contain costs, such as early payment penalties or late fees. Be sure to know the exact fees included in your payment amount.

Q.7 What is the difference between a payoff letter and a monthly account statement?

ANS. A payoff letter is a form of documentation that outlines the amount require to pay off a loan completely.

The monthly statement of account displays the balance and activity in your account over the specifi time.

Q.8 Can I use a payoff letter to obtain a consolidation loan?

ANS. A payoff statement can be utilize in certain situations when applying for a consolidation loan. Payoff statements detail the exact amount you owe for your current loans. This can assist you In determining The amount you’ll need To take out To pay off existing loans.

Q.9 What is a lien and how does it relate to a payoff letter?

ANS. Payoff statements are often linke to liens and inform you that legal claims have been file to take possession of the property if the full amount Is not made.

If you have an obligation against your home, be sure to know The procedure for releasing It after you’ve paid off your loan.

Q.10 How do I pay off my loan once I have a payoff letter?

ANS. The letter you receive to pay off your loan will inform you which address to send The money to And the best payment method. Follow the directions carefully to ensure that the loan is paid completely.