How Much Is Mortgage Payoff

How Much Is Mortgage Payoff: For homeowners seeking to settle the mortgage on their home, you might wonder what you’ll need to shell out to cover the loan completely.

This response will vary based on various variables, such As your good rate, The duration of your loan, And Any penalties or fees That could be imposed.

We’ll discuss the idea of mortgage payoff and the method of determining how much you’ll have to pay to satisfy the loan.

What Is a Mortgage Payoff Statement?

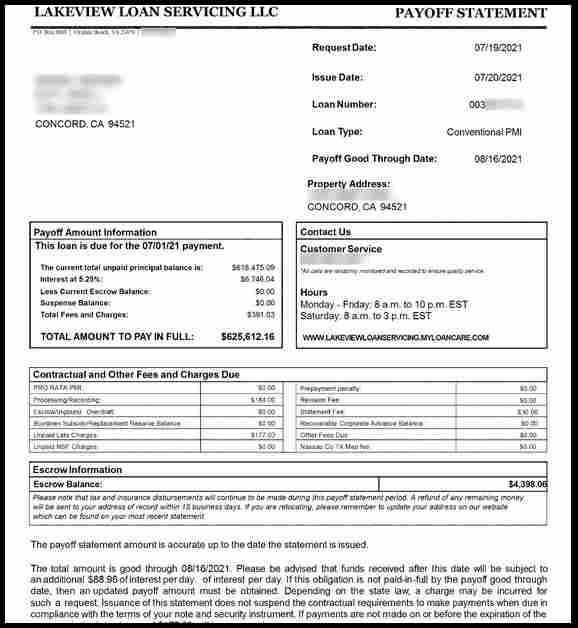

A mortgage statement of payoff, occasionally referred to as A note of payoff, Is A form of documentation that outlines the exact amount required to pay off your mortgage.

The amount you pay off isn’t only the outstanding balance; it also includes any interest due and any additional fees the lender might charge.

Lenders produce the mortgage payoff statement, which may be requested by homeowners who wish to know the exact amount required to settle their homes.

How to Get a Mortgage Payoff Statement

If you want an official mortgage statement, you’ll have To ask your lender for one. Based on the lender you have, you power be in a position to Ask for A payment statement via the Internet, over the telephone, or by mail.

Once you’ve asked for your payoff statement, your lender will send you A report which outlines the exact amount required to pay off the mortgage.

How Much Is Mortgage Payoff?

The amount required to repay your mortgage completely will vary based on several variables, including The interest rate, duration of your loan, and any costs or damages That may be imposed.

To figure out the amount you’ll have To pay to repay your loan fully, you’ll need an official mortgage payoff statement with your lender.

When you get your mortgage payoff report, it’ll reveal the exact amount required to repay your mortgage. The amount includes the outstanding balance, all fees or interest due, And Any penalties or fees which may be applicable.

When you’ve paid the balance in total, your mortgage Is fully paid off, and you’ll have the home you purchased in full.

Tips for Paying Off Your Mortgage

If you’re considering paying on your home mortgage, you can follow a few strategies to help you get there: your goals:

- Pay extra payments to your mortgage could aid in paying the loan off faster and reduce the cost of interest.

- Refinancing your mortgage may aid in reducing your interest rate As well As reduce The number of your monthly payments. This will make it easier To pay off the loan.

- Think about a loan with A shorter term. If you’re looking for a new mortgage, consider choosing a shorter duration. This could help you get your money back faster And reduce the interest cost.

- Please use windfalls to reduce your mortgage: If you can earn a windfall such as an inheritance or a bonus, consider it to pay off your mortgage.

- Create a budget: Creating your budget will aid in identifying areas where you could reduce your expenses and contribute more towards your mortgage.

Conclusion

The amount you’ll have to finish your home mortgage is a difficult process that relies on several aspects. For an accurate estimate of your mortgage’s payoff amount, getting an official statement from your loan provider is necessary.

When you’ve figured out how much you’ll be required To pay, you’ll be able To decide to take measures To repay your loan quicker And get closer To owning your house for free.

ALSO CLICK HERE: How Do I Write a Mortgage Payoff Letter

FAQs

Q.1 What is a mortgage payoff statement?

ANS. A mortgage statement reveals the precise amount required to repay your loan completely. The amount comprises your outstanding balance, any interest you have to pay, and any relevant fees or penalties.

Q.2 How do I get a mortgage payoff statement?

ANS. To get a mortgage payment statement, contact your lender And ask for one. Based on your lender, you might be able to request A payment statement online, over The telephone, or via mail.

Q.3 Is my payoff amount the same as my current balance?

ANS. Your payback amount differs from your balance. You may owe more than your current balance. Your loan payoff includes interest up to the day you pay it off. Your payout may include unpaid fees.

Q.4 Why do I need a mortgage payoff statement?

ANS. A mortgage payoff statement provides the exact amount needed to pay off your mortgage. This might help you budget and choose a mortgage.

Q.5 How is a mortgage payoff statement created?

ANS. Lenders create mortgage payoff statements. Ask your lender for a payback statement. To start the request process, your lender may require you to log in, call, or write.

Q.6 Can I calculate my mortgage payoff amount?

ANS. Formulas can calculate mortgage payoffs. Multiply the loan sum by the interest rate And divide by 365 To calculate The daily interest rate. The mortgage payoff amount is this figure multiplied by the loan balance and days until payoff.

Q.7 How can I pay off my mortgage early?

ANS. Extra payments, refinancing, A shorter loan term, windfalls, And budgeting can help you pay off your mortgage early.

Q.8 What is a pre-payment penalty?

ANS. Some lenders demand a fee for early mortgage payoff. Check with your lender about pre-payment penalties before paying off your mortgage early.

Q.9 What is the difference between a payoff statement and a monthly statement?

ANS. Payoff statements indicate the exact amount needed to pay off your mortgage. Monthly statements list your balance and payments.

Q.10 How can a mortgage payoff statement help me?

ANS. A mortgage payoff statement can tell you how much you need to pay off your mortgage. This might help you budget and choose a mortgage.