Is Payoff by Happy Money Legit?

Is Payoff by Happy Money Legit: Happy Money (previously named Payoff) might be a suitable alternative if you’re trying to consolidate your high-interest debit card balances.

However, is the Payoff service offered by Happy Money authentic? Here’s what you should be aware of.

What is Happy Money?

Happy Money is an online lender that offers personal loans to those looking to consolidate their debt from credit cards.

The company was initially named Payoff but switched its title to Happy Money in 2021 to reflect its larger goal to help people achieve financial health.

How does Happy Money work?

Happy Money offers fixed-rate private loans Ranging from $5,000 to $40,000 with periods ranging from two To five years.

These loans Are made for The consolidation of credit cards, and you can utilize the funds To pay off high-interest credit card debt and then pay one monthly installment in the direction of Happy Money At a lower interest rate.

Is Happy Money legit?

Happy Money is a legitimate lender accredited by the Better Business Bureau with An A+ rating. The company has been operational for over A year and has assisted hundreds of people in consolidating their debts from credit cards.

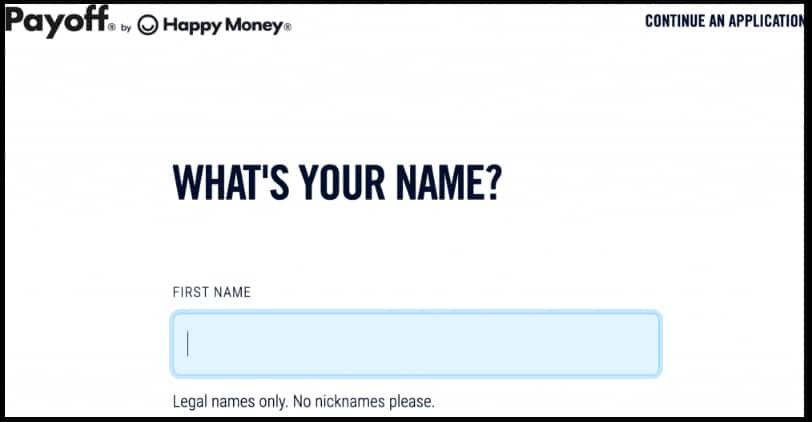

How do I apply for a Happy Money loan?

To be eligible to apply for a Happy Money loan, you’ll be required to offer An online application via the company site.

You’ll have to provide basic facts about yourself, including your name, lecture, Social Security digit, and details about your earnings and employment.

What are the eligibility requirements for a Happy Money loan?

To be eligible to receive A Happy Money loan, you have to meet the following conditions:

- It would help if you were The age of 18.

- The applicant must also be A U.S. national or permanent resident.

- You must be able To show A middle credit score of 640.

- You must earn at least the lowest per-year income of $40,000.

- It would help to keep A debt-to-income ratio of 50 percent or less.

What are the interest rates and fees for a Happy Money loan?

Happy Money offers fixed-rate personal loans with APRs ranging between 5.99 percent to 24.99 percent.

The rate of interest you can get will depend on your family’s credit scores, income, And other variables. Happy Money does not charge Any origination fees or penalties.

What are the pros and cons of a Happy Money loan?

Pros:

- Interest rates are low: Happy Money offers competitive interest rates for borrowers with good credit.

- No origination fee: Happy Money does not charge any origination charges or penalties for prepayment.

- Reporting on credit: Happy Money reports loan payments to the three main credit bureaus. This will help you improve your score on credit.

Cons:

- A limited loan purpose The Happy Money loans are available only for consolidation of credit cards, So they’re not the best option for financing other kinds of expenditures.

- Only a limited number of Happy Money is not offered for customers in Massachusetts and Nevada.

Final Thoughts

Happy Money is a legitimate lender that offers personal credit card consolidation loans. The Happy Money loan might be a suitable option if you want to reduce your credit card debts and decrease the interest rate.

However, you must search elsewhere if you’re looking to pay for other expenses. Similar to any investment decision essential to conduct your research and evaluate your options before making a decision.

FAQs

Q.1 What is Payoff by Happy Money?

ANS. Payoff by Happy Money offers high-interest credit card debt consolidation personal loans.

Q.2 Is Payoff by Happy Money legit?

ANS. Yes, Payoff by Happy Money is an authentic firm that partners with lending partners to assist customers in getting rid of credit card debt with high interest.

Q.3 What is the Payoff Loan?

ANS. This personalized loan provided by Payoff Happy Money consolidates multiple high-interest credit card debts into a single fixed monthly payment with lower annual percentage rates (APR).

Q.4 How does the Payoff Loan work?

ANS. By taking out a Payoff Loan, you can combine your high-interest credit card debts into A single fixed monthly payment with A lower interest rate. You could borrow up to $40,000; the loan period can be between two And five years.

Q.5 What are the eligibility requirements for a Payoff Loan?

ANS. To qualify for A Payoff loan, The applicant must have A recognition score 640 or A lowest annual salary of $40,000 And A debt-to-income ratio of 50 percent or less.

Q.6 What are the interest rates and fees for a Payoff Loan?

ANS. The interest rates for Payoff Loans vary between 5.99 percent to 24.99 percent, And there Are no origination costs or penalties for prepayment.

Q.7 Can I pre-qualify for a Payoff Loan?

ANS. You can pre-qualify for A Payoff loan on The Happy Money website without affecting your credit score.

Q.8 Does Payoff by Happy Money report loan payments to credit bureaus?

ANS. Yes, you can pay through Happy Money, which makes loan payments available At the top three credit bureaus. These will help you improve your score on credit.

Q.9 What are the pros of a Payoff Loan?

ANS. The benefits of a Payoff Loan are low-interest costs, no origination charges, prepayment penalties, And credit reporting To significant credit bureaus.

Q.10 What are the cons of a Payoff Loan?

ANS. The disadvantages of a Payoff Loan are that it is only a loan for specific purposes (only to consolidate credit cards) and the limited accessibility (not yet available in Massachusetts and Nevada).