What Happens to Gap Insurance When You Payoff Your Car

What Happens to Gap Insurance When You Payoff Your Car: Gap insurance pays for the difference between a vehicle’s real cash value and what you’re still owed on the lease or loan if your vehicle is damaged or stolen.

It’s supplemental coverage that can include in your insurance policy. What happens to gap insurance after you sell your vehicle?This article will explain the meaning gaps insurance and the way it works, and what happens to it if you decide to sell your car.

What is Gap Insurance?

Gap insurance is a form of insurance that protects that “gap” between the value of the car is worth And the amount owed by the driver on their lease or auto loan when The car Is wrecked or stolen. Without gap insurance, car owners can be liable for The remaining lease or loan credit for a vehicle they can no longer use.

Gap insurance is an option to pay the gap between the amount a fully packed vehicle is valued And the amount the driver must pay on the auto loan or lease.

How Does Gap Insurance Work?

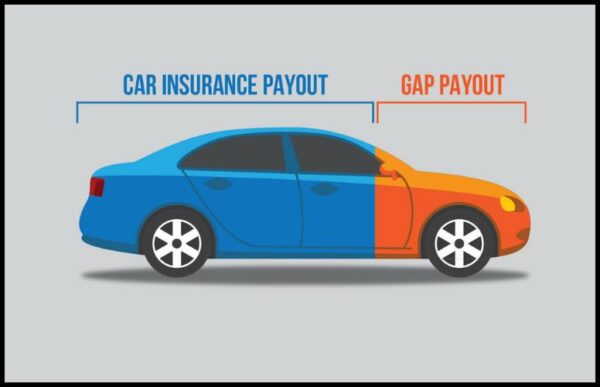

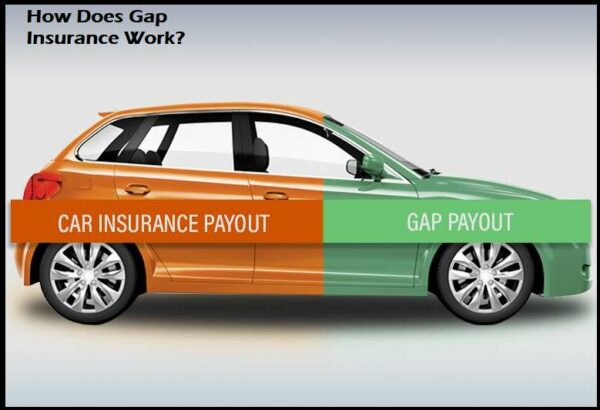

Gap insurance is a way to cover the dollar “gap” between the value of a vehicle is worth and the amount that is due on the lease or loan or lease, in the event of an accident that involves the totality of vehicles or theft.

The standard types of insurance provide the cash amount of the vehicle, which is why a driver who doesn’t have gap insurance could have to pay thousands of dollars for the car they don’t have.

For instance, you Are owed $25,000 on your car loan. However, your vehicle Is only worth just $20,000.

If your vehicle Is destroy And your insurance company cannot pay, They will pay you $20,000 And leave you with A gap of $5,000. If you’ve got gap insurance, it will cover the gap but not the deductible.

What Happens to Gap Insurance When You Payoff Your Car?

If you can pay off your vehicle, the gap insurance policy will no longer be require. This Is because you’re no longer In debt for cash on The loan you took out for your car, And your vehicle’s actual cash value is The same as its value. This means that you don’t have pay to pay to cover gap insurance anymore.

However, It Is important to remember That if you’re cover by gap insurance in your car insurance, You may have paid for it in advance.

In this instance, you could be eligible for a refund for the unutiliz portion of the gap insurance coverage. Make sure you contact the insurance company you have with to determine whether you’re eligible for the refund.

How to calculate gap insurance refund

To determine how much of a refund you’ll receive when you pay for GAP insurance upfront to get the policy, divide the amount of insurance cost by the number of months that you were covered coverage–this will give you your monthly price.

Once you’ve figur out your monthly fee, the next step is to divide it by the digit of the months you are staying on your approach.

Conclusion

Insurance for gaps is an optional insurance policy that can add to the insurance policy to pay for the gap between the amount owed on your vehicle lease or loan and your actual cash worth.

If you’ve paid off your car and the gap policy is not in use the policy is no longer requir, and you may be entitl to a refund for the amount you haven’t us from the insurance.

If you need clarification on whether you require gap insurance, consider your circumstances, the value of your car, And The conditions of your lease or car loan. Should you choose to make An educat And solid choice You can prepare yourself to be financially successful.

FAQs

Q.1 What is gap insurance?

ANS. Gap insurance is An optional type of car insurance that protects the “gap” between what A car Is worth And what the motorist owes on their auto loan or lease if the car is total or robbe.

Q.2 How does gap insurance work?

ANS. Gap insurance covers the dollar-amount “gap” between what a car is worth and what is owed on the loan or lease, in the event of a vehicle-totaling accident or theft. Standard types of insurance only cover the actual cash value of the car, so a driver without gap insurance could potentially owe thousands of dollars on a car they no longer have

Q.3 What happens to gap insurance when you payoff your car?

ANS. When you payoff your car, your gap insurance coverage will no longer be necessary. This Is because you no longer owe Any cash on your car loan, And The actual cash value of your car is now similar to its worth. Therefore, you won’t need To pay for gap insurance anymore.

Q.4 Do I need gap insurance?

ANS. Drivers should consider getting gap insurance if they made a small loan down payment, lease their car, or have a car that depreciates quickly.

Gap insurance pays for the difference between what a totale car is worth and what the driver still owes on their auto loan or lease

Q.5 How much does gap insurance cost?

ANS. The cost for gap coverage varies by insurer. You can get an exact price for loan/lease payoff coverage, which is similar to gap coverage, from your insurance provider

Q.6 What happens if I have gap insurance and my car is total?

ANS. If you are cover by the gap insurance and your vehicle is damag, the insurance company can pay you the car’s cash value less your deductible. A gap insurance policy will pay your gap between what you owe on your car loan or lease and the actual cash value.

Q.7 What happens if I don’t have gap insurance and my car is total?

ANS. If you do not possess gaps insurance and your vehicle is damag the insurance company is required to pay you the cash value of the car and less the deductible. If you have more debt on the credit or loan than cash value of the car and you’re accountable for the difference.

Q.8 Can I cancel my gap insurance?

ANS. Yes, it is possible to can change your gap insurance coverage if you do not require it. If you choose to terminate your insurance, you may be qualifi to obtain a rebate for the part you did not use.

Q.9 When should I cancel my gap insurance?

ANS. You should cancel your gap insurance when the amount you owe on your car loan or lease is less than the actual cash value of your car, or only a little more. Once the amount you owe is less than your car’s value, there’s no reason to keep gap insurance

Q.10 Is gap insurance the same as loan/lease payoff coverage?

ANS. Gap insurance is similar to loan/lease coverage however, they’re not the identical. Gap insurance is the coverage that covers the difference between the amount you owe on your lease or car loan and what’s the real cash amount of your vehicle as well as loan/lease payment coverage only covers the amount on your car lease or loan if your vehicle is damag or stolen.