What Is a 10 Day Payoff Letter: If you’re refinancing your college loans, you might have been offered a payoff letter of 10 days Letter. What is it, As well As why It’s so important? We’ll address these queries and more.

What is a 10-day payoff letter?

A 10-day payoff letter document that details the exact amount required to repay your student loans completely in 10 days.

It is required to present this document to your new lender during this refinancing phase. The letter will help determine the exact amount required to repay your current loans so there’s no balance on your loan after the refinance process.

Why is a 10-day payoff letter important?

Your 10-day payoff notice Is vital To make sure That The lender you choose to work with sends the right amount of money to make sure there’s no unpaid loan balance remaining after your refinance.

If you do not provide An accurate 10-day payoff amount, you could end up paying more Than you expected.

How do I request a 10-day payoff letter?

Most lenders for student loans allow the request of a 10-day payoff when you sign in to your account online. Some lenders don’t lenders do, and you might have to call or contact your servicer for your loan.

If you need To request A 10 days payoff directly from your lender, you’ll need To provide some basic details, such as:

- Your loan number

- The address to which the payoff letter for 10 days should be delivered

You’ll need to request that each lender provide an individual 10-day payment letter If you have several loans.

What costs are associated with a 10-day payoff?

A variety of costs can be associated with a payoff of 10 days for student loans, such as the interest accruing until the date of payoff As well As Any prepayment penalties and any unpaid expenses or penalties.

It is important to read the payoff estimate to know the total amount to be paid and any costs associated with it.

How long does it take to receive a 10-day payoff letter?

It usually takes three to 5 business days for you To get A 10-day payoff letter from your bank. It can be different dependent on the lender And the method you use to want to receive the letter.

Can I pay off my student loans early without a 10-day payoff letter?

Yes, you can pay your school loan early without a 10-day payoff notice. If you’re refinancing your loan, you’ll have to provide the correct payment for your 10-day payment to ensure there’s no balance left to be paid off after the method of refinancing.

Can I negotiate my 10-day payoff amount?

You cannot change the amount you pay off in 10 days. Your lender sets the piece and represents the amount needed to repay your loan within 10 days.

What happens if I don’t provide a 10-day payoff letter?

If you don’t give the correct amount for a 10-day payment, it could result In paying more Than you had anticipated. This could result in higher fees And interest charges.

Can I get a refund if I overpay my student loans?

If you’ve overpaid for your loan, you can request A refund from the lender. It’s crucial To submit An accurate 10 days payoff amount so you don’t go over initially.

How can I make sure I’m providing an accurate 10-day payoff amount?

To ensure you’re giving a precise 10 days payoff, double-check your loans And interest rates before sending the letter. You can also utilize online calculators or call your lender directly to get assistance.

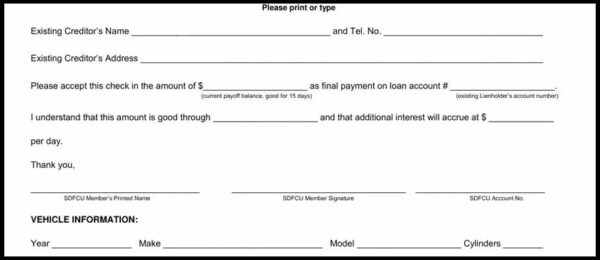

Types of Payoff Letters

A different type of payment letter is a formal one you receive after you pay off the loan. The letter informs you that the debt is paid off and can be useful if you prove that the loan has been paid off.

For instance, if you’re selling a vehicle you owe money on and your buyer is unwilling to proceed without a clear title. Lenders could take a long time to take away the liens and issue title documents, so this kind of letter may help keep the process going.

A letter of payoff can be useful when you’ve discovered mistakes in your credit score. If the credit bureau isn’t reporting a loan as closed, which you’ve successfully paid back, the bureau will require documents to rectify the mistake. The lender’s letter can help to get the errors corrected.

conclusion

A 10-day payment letter is a crucial document that outlines the exact amount required to pay off your student loans completely in 10 days.

By supplying an accurate 10-day payment amount when you are in the refinancing process, you will be sure there’s no unpaid loan balance after this process.

If you have any concerns regarding getting or using a 10-day payment letter, call your lender for assistance.

ALSO READ

FAQs

Q.1 What is a 10-day payoff letter?

ANS. A letter of 10-day payment Is An official document that outlines the exact amount required to repay your student loans completely within 10 days.

Q.2 Why is a 10-day payoff letter important?

ANS. Your 10-day payoff letter ensures that your new lender sends the right amount of money so there is no remaining loan debt after your refinance.

Q.3 How do I request a 10-day payoff letter?

ANS. Online accounts let you request a 10-day payback from most student loan providers. Call or email your loan servicer if it doesn’t.

Q.4 What costs are associated with a 10-day payoff?

ANS. A 10-day student loan payoff may include interest, prepayment penalties, And fees.

Q.5 How long does it take to receive a 10-day payoff letter?

ANS. Lenders send 10-day payment letters in three to five business days.

Q.6 Can I pay off my student loans early without a 10-day payoff letter?

ANS. You can prepay student loans without a 10-day letter. To avoid a remaining loan balance after refinancing, you must submit an appropriate 10-day payoff amount.

Q.7 Can I negotiate my 10-day payoff amount?

ANS. Your 10-day payback cannot be negotiated. Your lender sets this amount to pay off your loans in 10 days.

Q.8 What happens if I don’t provide a 10-day payoff letter?

ANS. You may owe more if you don’t submit an appropriate 10-day payoff amount. Interest and fees may increase.

Q.9 Can I get a refund if I overpay my student loans?

ANS. If you overpay student loans, your lender choice reimburses you.

Q.10 How can I make sure I’m providing an accurate 10-day payoff amount?

ANS. Double-check your loan amounts and interest rates before obtaining the letter to ensure an appropriate 10-day payoff amount. You can also utilize internet calculators or ask your lender.